Steps to incorporate a business doesn’t have to be difficult.

Many years ago it was a necessity to walk into a lawyer’s office and spend expensive fees to set up a business structure. This isn’t the case any longer, as you can easily do this online.

A business can be set up as a C Corporation, S Corporation, Limited Liability Corporation (LLC) or non-profit.

Incorporate Your Business for Free (Only Pay State Fees)

Why Business Incorporation?

There are three main reasons to incorporate a business:

1. Transfer liability to a business entity which can protect your personal assets and minimize financial risk.

2. Change business tax filing status to a structure that often saves a business more money in the first tax year then what they would spend in incorporation fees.

3. Easier to raise capital for your business.

What are the benefits of incorporating a business?

Incorporating a business has many benefits, both for the business itself and for its owners. Incorporating a business can help to protect the owners from personal liability, provide tax advantages, and help to establish credibility. 1. Personal Liability Protection: Incorporating a business can help to protect the owners from personal liability. When a business is incorporated, the owners are not personally liable for the debts and obligations of the business.

What are the drawbacks of incorporating a business?

The drawbacks of incorporating a business can be significant and should be carefully considered before taking the plunge. 1. Cost: Incorporating a business can be expensive. Depending on the type of business and the state in which you incorporate, the costs can range from hundreds to thousands of dollars. Additionally, you may need to pay for professional services such as an attorney or accountant to help you with the process.

How much does it cost to incorporate a business?

The cost of incorporating a business can vary significantly depending on the type of business structure you choose and the state in which you incorporate. Generally, the cost of incorporating a business includes the filing fee charged by the state, the cost of preparing the necessary documents, and the cost of any professional services you may need to help you with the process. The filing fee for incorporating a business varies from state to state, but typically ranges from $50 to $500.

What are the requirements for incorporating a business?

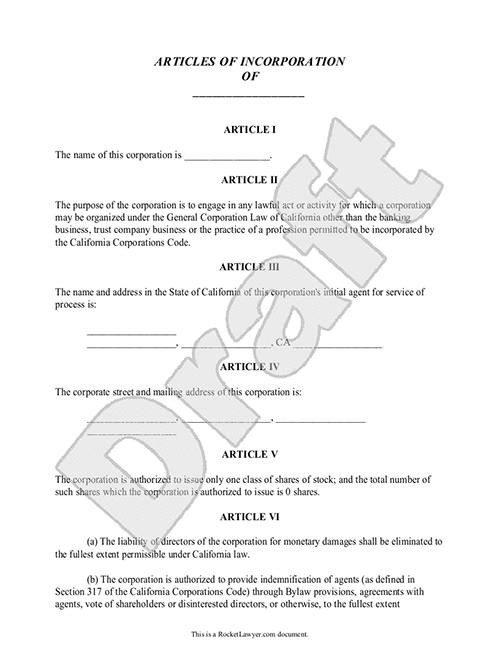

Incorporating a business is a complex process that involves a variety of steps and requirements. Depending on the type of business you are forming, the requirements may vary. Generally, the following steps and requirements are necessary for incorporating a business: 1. Choose a business name: The name of your business must be unique and not already in use by another business. It must also comply with the naming regulations of your state.

What are the steps involved in incorporating a business?

Choose a Business Structure: The first step in incorporating a business is deciding which type of business structure to use. The most common types of business structures are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own advantages and disadvantages, so it’s important to consider which structure is best for your business.

How long does it take to incorporate a business?

The answer to this question depends on a variety of factors, including the type of business you are incorporating, the state in which you are incorporating, and the complexity of your business structure. Generally speaking, the process of incorporating a business can take anywhere from a few days to several weeks. If you are forming a simple business structure, such as a sole proprietorship or a limited liability company (LLC), the process of incorporating can be relatively quick.

What is the difference between a corporation and a limited liability company (LLC)?

The primary difference between a corporation and a limited liability company (LLC) is the way in which they are taxed. A corporation is a separate legal entity from its owners, meaning that it is taxed separately from its owners. This means that the corporation pays taxes on its profits, and the owners pay taxes on their individual income. A limited liability company, on the other hand, is not a separate legal entity from its owners.

What is the difference between a C corporation and an S corporation?

The primary difference between a C corporation and an S corporation is the way in which they are taxed. A C corporation is a separate legal entity that pays taxes on its own income, while an S corporation is a pass-through entity, meaning the income is passed through to the shareholders and taxed on their individual tax returns. C corporations are subject to double taxation, meaning the corporation pays taxes on its income and then the shareholders pay taxes on the dividends they receive from the corporation.

Can I incorporate my sole proprietorship?

Yes, you can incorporate your sole proprietorship. Incorporating your sole proprietorship is a great way to protect your personal assets from any liabilities of the business. It also provides you with additional tax benefits and can help you to raise capital for your business. In order to incorporate your sole proprietorship, you will need to register your business with the state in which you operate.

Should I incorporate my business?

The decision to incorporate your business is an important one and should not be taken lightly. There are many factors to consider when deciding whether or not to incorporate your business, such as the type of business you are running, the amount of money you have to invest, and the legal and tax implications of incorporating. Incorporating your business can provide many benefits, such as limited liability protection, the ability to raise capital more easily, and the potential for tax savings.